This cold calling series is written in partnership between ProvenWorks and RocketPhone.Ai

This article is not intended as legal advice. This is guidance that discusses specific tools which, when used correctly, can form part of a solution to ensure compliance. For legal advice, consult a qualified legal practitioner.

Cold calling, done right, can be a highly effective way to reach potential customers. However, it’s also one of the most highly regulated forms of outreach. Therefore, it’s essential to navigate the regulatory landscape carefully to avoid costly fines and damage to your reputation (and in some cases, even jail time). In the UK, there are specific regulations governing all areas of cold calling practices, from how you obtain data, what you say and how you store information. These regulations are aimed at protecting consumers and ensuring fair business practices. Let’s explore these regulations and the potential consequences of breaching them.

Regulations for cold calling in the UK

When making cold calls in the UK, there are multiple national and international regulations that need to be considered. These include, the Information Commissioner’s Office (ICO), GDPR, Financial Conduct Authority and Ofcom.

The Telephone Preference Service (TPS) and Corporate Telephone Service (CTPS)

The Telephone Preference Service (TPS) and Corporate Telephone Preference Service (CTPS) allow individuals and businesses to opt out of receiving cold calls. The TPS is a free service that currently contains over 17 million UK phone numbers. Therefore, it’s crucial to screen your calling lists at least every 28 days against these databases to ensure compliance. Ignoring TPS and CTPS registrations is illegal and can result in significant fines of up to £500,000 from regulatory bodies such as the Information Commissioner’s Office (ICO).

UK General Data Protection Regulation (GDPR)

Under the UK General Data Protection Regulation (GDPR), businesses must obtain explicit consent from individuals before contacting them for marketing purposes or have reasonable justification that they are contacting them with legitimate interest. Consent must be freely given, specific, informed, and unambiguous for areas such as recording phone conversations. GDPR also mandates that individuals have the right to opt out of further communications, at which point all further marketing communication must cease. Failure to comply with GDPR can result in severe penalties, including fines of up to €20 million or 4% of annual global turnover, whichever is higher GDPR (2018).

Financial Conduct Authority (FCA) – protecting vulnerable customers

The FCA has a keen focus on protecting those who may be classed as vulnerable from being mis-sold to. Businesses must take extra care when cold calling vulnerable customers, such as the elderly or those with mental health issues. Mis-selling on the phone to vulnerable customers can have serious consequences, including legal action and damage to your brand’s reputation. It’s essential to train staff to recognise and handle vulnerable customers sensitively and ethically. Fines implemented by the FCA can reach into the £10’s of millions FCA (2021).

Ofcom and silent call rates

Cold calling through an automated calling or dialler technology, is widely used for outbound sales and telemarketing campaigns. However, in the UK, it is important to adhere to the regulations set by Ofcom. Silent calls occur when someone answers the phone but hears silence on the other end. This could be caused by calls being abandoned or connected but an agent does not speak or is on mute. Ofcom’s regulations state that the target for dropped calls (abandoned calls) should be 0%, not the previously misunderstood 3%. Despite Ofcom’s clarification, many people in the industry still think the 3% rule applies – and some even run their diallers with 3% in mind. Some suppliers of dialler solutions even promote the fact they are (falsely) compliant by ensuring a 3% maximum rate. The consequences of being a repeat offender however is severe. Ofcom may take enforcement action, including fining the caller up to £2 million Ofcom (2020).

Consequences of breaching regulations when cold calling

As outlined above, the potential financial consequences of breaching cold calling regulations can be severe. But it’s often the negative publicity resulting from regulatory breaches that can have even longer-lasting effects on brand perception and customer loyalty. Additionally, legal action from affected individuals or class-action lawsuits can significantly worsen any financial liabilities.

Cold calling at scale, compliantly

Whilst the debate about the value of cold calling goes on, the importance of abiding by laws and regulations is undisputed. Consequently, understanding and adhering to cold calling regulations is crucial for businesses seeking to engage in cold calling. By complying with regulations such as TPS, GDPR, and FCA Consumer Duty Rules and taking steps to protect vulnerable customers, businesses can mitigate risks and build trust with consumers. There are plenty of Independent Software Vendors (ISV’s) on the Salesforce AppExchange that help ensure compliance. One of the effective solutions include:

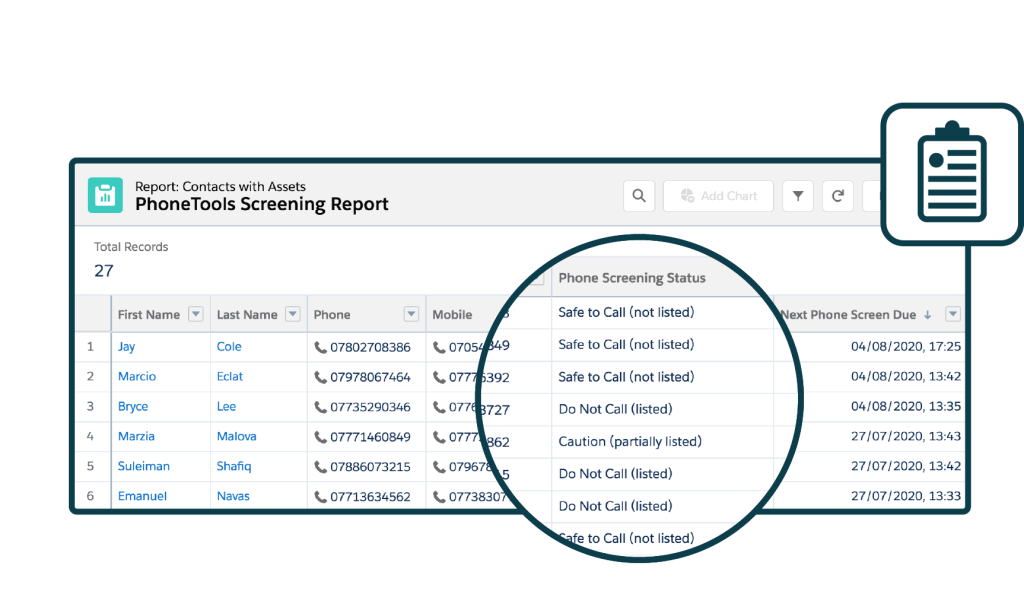

PhoneTools by ProvenWorks: ensure UK compliance

Maintain compliance with UK data privacy laws by screening your phone numbers against the Telephone Preference Service (TPS) and Corporate Telephone Preference Service (CTPS) databases. PhoneTools is a solution available on the Salesforce AppExchange that enables individuals and businesses to opt out of receiving cold calls. This simple, well-integrated AppExchange solution lets you run instant reports and include screening status in your outbound call queue, ensuring seamless compliance.

Contacting someone registered with TPS or CTPS is likely to upset them, damaging your brand’s reputation, and poses a significant legal risk. Failure to do so risks significant repetitional damage and hefty fines from the ICO.

Learn more about PhoneTools here

Join us in our next blog, where we dive deep into the world of cold calling and reveal how it can be a game-changer for your business. Don’t miss out on insights that could transform your sales approach!